Have you ever wondered how different parts of your working life might connect with your future financial security? It's a big question, and for many, it often brings up thoughts about Social Security. For a long time, there was a particular rule, a calculation really, that could make a difference in how much money someone got from Social Security if they also had a pension from a certain kind of job. This rule, known as the Windfall Elimination Provision, or WEP for short, was a topic many people tried to make sense of.

So, what was this WEP all about? In a way, it was a formula that could lessen the amount of money you received from your Social Security retirement or disability payments. This would happen if you also collected a pension from a job where you hadn't paid Social Security taxes. It was a rule put into place to address situations where someone might have earned a pension from a job that didn't contribute to Social Security, while also earning Social Security benefits from other work. It felt like a balancing act, trying to ensure fairness across different work histories, you know?

Well, things have changed. This WEP, which Congress put into effect back in 1983, was actually taken off the books in late 2024. That's a pretty big shift for people who have pensions from what they call "noncovered" jobs – those where Social Security taxes weren't part of the paycheck. This means the way your future benefits are looked at could be quite different now. It’s almost as if a certain path that used to be there for some folks has now been closed, in a good way, for many.

- Paul Jr Designs Public Figure

- Cnn Omar Jimenez Wife

- Dandruff Shampoos For Color Treated Hair

- Is Suge Knight Still In Jail

- Meryl Streep Sequel Rule

Table of Contents

- What Was the WEP, Really?

- Why Did the WEP Exist? The wep natalie part 3 Story

- What Are "Noncovered" Jobs and How Did They Fit into wep natalie part 3?

- How Did the WEP Change Your Social Security Money?

- What Happened to the WEP and What Does It Mean for wep natalie part 3?

- Can You Still Get Both a Pension and Social Security Payments?

- How Do Social Security Payments Get Recalculated Each Year?

- Looking Ahead to Changes in 2025 and Beyond with wep natalie part 3

What Was the WEP, Really?

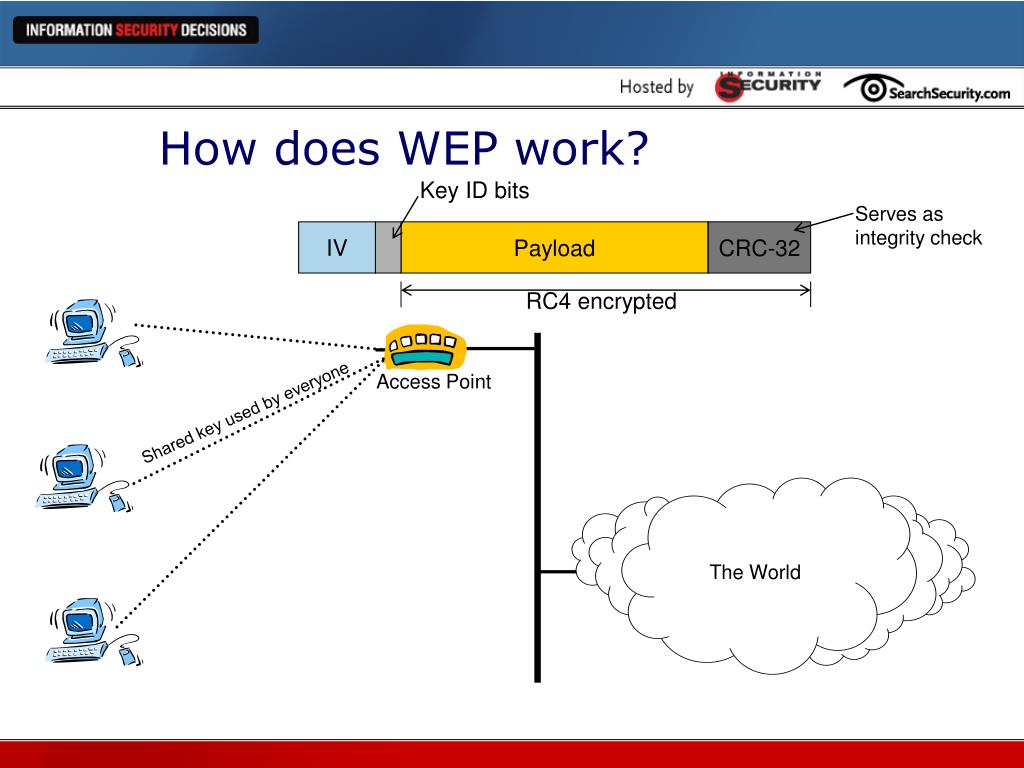

The Windfall Elimination Provision, or WEP, was, you know, a specific method used to figure out Social Security payments. It came into play if a person received a pension from a job where they hadn't paid Social Security taxes. Think of it like this: if you worked for a good number of years in a job that didn't take out Social Security contributions from your pay, but you also had other jobs where you did pay into the system, the WEP could step in. It was a way for the system to adjust your Social Security benefit amount, making it a bit smaller than it would have been otherwise. It wasn't about taking away your Social Security entirely, but rather, it was about adjusting the final sum.

This rule, the WEP, was put in place to address what some people saw as an advantage. If someone got a pension from a job that didn't have Social Security taxes taken out, and then also received full Social Security benefits from other work, it could look like they were getting a benefit that wasn't fully "earned" in the same way as someone who only paid into Social Security their whole working life. So, it was meant to create a more level playing field, you could say. It was a way to make sure that the system felt fair for everyone, or at least that was the idea behind it.

The WEP specifically looked at your earnings record. It considered how many years you had "substantial earnings" under Social Security. If you had fewer than 30 years of those substantial earnings, and you also had a non-covered pension, then the WEP would likely apply. The reduction amount would vary based on how many years of substantial earnings you did have. It was a graduated system, meaning the less you paid into Social Security from covered work, the bigger the potential reduction. It really did add a layer of thought to retirement planning for a lot of people.

- Why Doesnt Eminem Smile

- Sexy Mrs Santa Outfit

- Woody Harrelson Merle Dixon

- Jenna Bush Queso Recipe

- Cardi B Ex Tommy

It's worth remembering that this provision was a federal law. It applied across the country, affecting people in many different professions and states. For example, some government workers, like teachers or police officers in certain states, might have been in jobs that didn't pay into Social Security. If these folks also had other jobs, perhaps part-time work or earlier careers, where they did pay Social Security taxes, the WEP could affect their retirement income. It was a piece of the puzzle that many had to figure out as they got closer to their retirement years, very much so.

Why Did the WEP Exist? The wep natalie part 3 Story

The WEP came about because of a particular situation. Before this rule, people who worked in jobs where they didn't pay Social Security taxes, but who also had some work experience where they did pay these taxes, could sometimes get what seemed like a better deal. Social Security benefits are figured using a formula that is weighted to help lower-income workers. This means that the first part of your earnings counts more heavily towards your benefit. So, if someone had a career in a non-covered job and a good pension, and then just a few years of covered work, their Social Security benefit from those few years could look artificially high, almost. It was like they were getting the benefit of the lower-income weighting, even though their overall career earnings were quite good because of their non-covered pension. That's why, you know, this rule came into being.

The idea behind the WEP was to prevent what was called a "windfall." A windfall, in this context, was seen as getting a higher Social Security benefit than was truly intended for someone with a substantial non-covered pension. It was an attempt to make the system more equitable, to ensure that people who spent their entire careers in jobs paying into Social Security weren't disadvantaged compared to those who had a mix of covered and non-covered work. So, in some respects, it was about balancing the books for the Social Security system, making sure it felt fair to all contributors. This is part of the wep natalie part 3 discussion, as it helps us see the bigger picture.

This rule, the WEP, was put in place by Congress in 1983. It was a response to concerns about how certain pension plans interacted with Social Security. The goal was to adjust the Social Security benefit amount for those who also received a pension from work where they didn't contribute to Social Security. It really aimed to stop what was seen as an unintended advantage. It was a complex issue, with many different viewpoints on whether it was truly fair or not. But for decades, it was a part of the Social Security landscape, something many people had to consider as they planned for their later years.

It's important to understand that the WEP wasn't meant to punish anyone. Instead, it was a structural adjustment within the Social Security benefit formula. It recognized that people with non-covered pensions already had a form of retirement income from their work, and that the Social Security benefit formula was designed primarily for those whose Social Security payments would be their main source of retirement income. So, it was about making sure the system worked as intended for everyone, you know, given the different ways people earn their retirement money. The history of this rule is quite interesting, and it certainly shaped many people's financial plans.

What Are "Noncovered" Jobs and How Did They Fit into wep natalie part 3?

"Noncovered" jobs are, basically, positions where you don't pay Social Security taxes from your earnings. This is different from most private sector jobs in the United States, where Social Security and Medicare taxes (FICA taxes) are automatically taken out of your paycheck. For example, some state and local government employees, like teachers, firefighters, or police officers, might be in pension plans that are separate from Social Security. This means their employer and they themselves contribute to a different retirement system, not the federal Social Security one. That's a key distinction.

The reason these jobs are "noncovered" often goes back to historical agreements or state laws. Some states or local governments opted out of the Social Security system for their employees many years ago, choosing instead to set up their own pension programs. These programs are often quite good, providing a solid retirement income. However, because no Social Security taxes were paid on those earnings, the WEP was put in place to adjust for that. It was a way to make sure that the Social Security system wasn't, you know, subsidizing retirement for people who hadn't contributed to it for a significant portion of their career. This is a big part of understanding the wep natalie part 3 discussion.

So, if you worked in a "noncovered" job for a period and then also worked in a "covered" job (where you did pay Social Security taxes), the WEP could come into play. Your Social Security benefit from the covered work would be calculated, and then, if you also received a pension from that non-covered work, the WEP formula would reduce the Social Security amount. It was a specific calculation that looked at your years of covered earnings and the amount of your non-covered pension. It really made people think about their entire work history when planning for retirement.

It's worth noting that the WEP didn't affect everyone with a non-covered pension. For instance, if you had 30 or more years of what the Social Security Administration considers "substantial earnings" in covered employment, the WEP wouldn't apply to you. The rule was primarily aimed at those who had a mix of covered and non-covered work, with fewer than 30 years of significant contributions to Social Security. This distinction was quite important for many people trying to figure out their future income. It was a specific kind of situation that the WEP was designed to address, you know.

How Did the WEP Change Your Social Security Money?

When the WEP was active, it changed your Social Security money by using a modified formula to figure out your benefit. Normally, your Social Security benefit is based on your highest 35 years of earnings from jobs where you paid Social Security taxes. The formula then applies different percentages to different parts of your average monthly earnings. For example, the first part of your earnings gets a higher percentage, then the next part gets a lower percentage, and so on. This is meant to give a bit more help to those with lower lifetime earnings, you know, to ensure a basic safety net.

However, if the WEP applied to you, that first, higher percentage in the formula would be reduced. Instead of, say, 90 percent of your first portion of earnings counting towards your benefit, it might be reduced to 40 percent. This meant that the overall amount of your Social Security payment would be smaller than it would have been if you didn't have that non-covered pension. It was a direct reduction, specifically targeting that part of the formula that usually benefits lower earners. It truly made a difference in the final number many people saw.

The exact amount of the reduction depended on a couple of things. One factor was how many years you had of "substantial earnings" under Social Security. If you had between 21 and 29 years of substantial earnings, the reduction would be less severe than if you had fewer than 20 years. If you had 30 or more years of substantial earnings, the WEP didn't apply at all. So, the more you paid into Social Security, the less impact the WEP would have had on your benefit. It was a sliding scale, in a way, designed to be fairer based on your contribution history.

It's important to remember that the WEP reduced your Social Security benefit; it didn't eliminate it entirely. You could still get both a pension from a non-covered job and Social Security payments. The WEP simply adjusted the Social Security portion to account for the other pension. Many people found this rule a bit confusing, and it often required a good bit of explanation to understand how it would affect their personal situation. It was a piece of the puzzle that made retirement planning a little more complex for some folks, you know.

What Happened to the WEP and What Does It Mean for wep natalie part 3?

The big news is that the Windfall Elimination Provision, or WEP, was taken off the books in late 2024. This means that the formula that could reduce your Social Security benefits because of a non-covered pension is no longer in effect. This is a pretty significant change for many people who were planning their retirement or who are already receiving benefits. It means that, for those affected, their Social Security payments will no longer be subject to that particular reduction. It's almost as if a weight has been lifted for some folks, giving them a bit more financial breathing room.

This repeal means that if you have a pension from a job where you didn't pay Social Security taxes, your Social Security retirement or disability benefit will now be calculated without the WEP adjustment. This could mean a higher Social Security payment for you than you might have expected under the old rules. It's a positive development for those who were concerned about how their non-covered pension would impact their Social Security income. This change is a key part of the wep natalie part 3 discussion, as it impacts many people's futures.

The decision to repeal the WEP was the result of a lot of discussion and advocacy over the years. Many people felt that the WEP was unfair, especially to those who had contributed to Social Security for many years but also had a pension from a non-covered job. They argued that it penalized people for having diverse work histories. So, the repeal reflects a shift in how these benefits are viewed and calculated. It's a testament to ongoing efforts to make the Social Security system more responsive to the needs of its beneficiaries, you know.

For those who were already receiving benefits that were reduced by the WEP, the repeal should mean an increase in their Social Security payments. For those who are still working and planning for retirement, it means they no longer have to factor in the WEP reduction when estimating their future Social Security income. This simplifies retirement planning for a good number of people. It's a change that, really, has a direct and positive impact on the financial outlook of many American workers and retirees. This is, you know, a major piece of news in the world of retirement benefits.

Can You Still Get Both a Pension and Social Security Payments?

Yes, absolutely! Nothing stops you from getting both a pension from a job and Social Security payments. This has always been the case, even when the WEP was active. The WEP simply adjusted the amount of your Social Security payment if you also had a non-covered pension. It never prevented you from receiving both. So, if you've worked in jobs that provided a pension and also paid into Social Security, you can expect to receive both types of income in your retirement. It's a common situation for many people, you know, to have multiple sources of retirement money.

With the repeal of the WEP in late 2024, a recent federal law now ensures that having a non-covered pension won't change your Social Security benefit amount. This is a big deal because it removes the previous reduction. So, if you qualify for Social Security and you also collect a pension from a job that didn't pay FICA taxes, your Social Security income will now be calculated without that WEP reduction. This means your Social Security payment will be higher than it would have been under the old rules. It truly simplifies things for a lot of folks.

This change makes planning for retirement a bit more straightforward for those with mixed work histories. You no longer have to worry about that specific reduction. Your Social Security benefit will be figured based on your covered earnings, just like for anyone else, without the WEP coming into play because of your non-covered pension. It's a clear signal that the government wants to make sure people get the full benefit they've earned through their Social Security contributions, regardless of other pension income. That's a pretty important shift, you know, for financial security.

It's always a good idea to check your Social Security earnings record regularly. You can do this by creating an account on the Social Security Administration's website. This lets you see your reported earnings and get an estimate of your future benefits. While the WEP is gone, it's still wise to keep an eye on your overall retirement picture, including any pensions you might have. Having all your information handy helps you make good choices about your future. It's a way to stay on top of your financial well-being, very much so.

How Do Social Security Payments Get Recalculated Each Year?

The Social Security Administration, or SSA, regularly recalculates your benefits each year. This is a normal part of the process and happens for a few different reasons. One main reason is based on your recent work records and earnings. If you continue to work even after you start receiving benefits, and your earnings are higher than some of your past years, the SSA will factor that in. They want to make sure your benefit reflects your most current and highest earnings. So, it's a way of keeping your benefit amount up-to-date with your work history, you know.

Each year, the SSA looks at your earnings record. They consider your highest 35 years of earnings when figuring your primary benefit amount. If your earnings in a recent year are higher than one of your previous 35 highest earning years, that lower earning year will be replaced with the new, higher earning year. This can lead to a slight increase in your monthly Social Security payment. It's a positive adjustment that can happen as long as you continue to work and earn money that contributes to Social Security. It's a system that, really, tries to give you credit for all your contributions.

Another reason for annual adjustments is the Cost-of-Living Adjustment, or COLA. This is an increase that Social Security beneficiaries receive to help their payments keep pace with inflation. The COLA is usually announced in the fall and goes into effect in January of the following year. It's designed to help maintain the purchasing power of your benefits over time, as prices for goods and services tend to go up. So, even if your earnings record doesn't change, your benefit amount can still go up due to COLA. It's a way to ensure your money stretches a bit further, you know.

The SSA also makes adjustments for things like Medicare premiums. If your Medicare Part B premiums are deducted directly from your Social Security payment, that amount can change each year. These changes are usually announced around the same time as the COLA. So, while your gross benefit might go up due to COLA, your net payment could be affected by changes in Medicare costs. It's all part of the regular yearly adjustments that happen with Social Security. It's a good idea to stay informed about these changes, very much so.

Looking Ahead to Changes in 2025 and Beyond with wep natalie part 3

Changes to retirement benefits happen every year, and 2025 will be no different. These changes can affect various aspects of your financial life in retirement, from your Social Security payments to what you pay for Medicare. It's important to keep an eye on these updates because they can directly impact your budget and your overall financial security. The government makes these adjustments based on economic factors, legislative changes, and the ongoing needs of the Social Security and Medicare programs. So, it's a dynamic system, you know, that's always adapting.

For 2025, we can expect to see adjustments to the Social Security Cost-of-Living Adjustment (COLA), which will affect how much your monthly payment is. The COLA is typically announced in October, so we'll know the exact percentage closer to the end of the year. This adjustment helps your benefits keep up with the cost of living. It's a crucial part of ensuring that retirees' incomes don't lose value over time. So, it's something many people look forward to each year, as it often means a little bit more money in their pocket.

Beyond Social Security payments, there will also be changes to Medicare costs in 2025. This includes premiums for Medicare Part B, which covers doctor visits and outpatient care, as well as deductibles and co-payments for various services. These costs can vary depending on your income level, so it's a good idea to review the official announcements from Medicare as they become available. Understanding these changes helps you budget for your healthcare expenses in retirement. It's a big piece of the financial puzzle for many older adults, very much so.

Other changes that might occur in 2025 include adjustments to the Social Security earnings limit for those who work while receiving benefits before their full retirement age. There can also be changes to the maximum amount of earnings subject to Social Security taxes. These kinds of adjustments are made to keep the Social Security system financially sound and to reflect current economic conditions. Staying informed about these yearly updates is a good way to manage your retirement finances effectively. It's all part of making sure you're prepared for what's ahead, you know, especially as we continue to discuss topics like wep natalie part 3.

- Sam Owens Stranger Things

- Emotional Birthday Wishes For My First Son

- Makes Me Want A Hot Dog Real Bad Actress

- Michael Myers Artwork

- Did Scarface Have A Scar